I often think back to my days leading procurement organizations and wonder why it was so difficult to get the teams to focus on the deeper discussions about building long term category strategies. Our procurement staff was over worked and stretched thin simply running RFP after RFP, to meet the immediate needs of their clients. But that old saying “When you don’t have time to plan, you need to take the time to plan” still makes a lot of sense. I remember how busy we were sourcing medical education events at a pharma company where I worked. We literally worked on thousands of these field meetings and could never seem to get out from under all the work. Our procurement lead stepped back and worked with her internal clients to build a strategy that consolidated the supply base, and built a pricing model and allowed her to only work on those events that fell outside of the guidelines in the model. As a result, the workload dropped by more than 90% and the huge savings that were captured put her in great favor with her primary client and allowed the team to work on many other sourcing projects.

Nothing we do as procurement professionals is as important as developing the right approach to a category with the input and help of our internal stakeholders. It puts us all on the same track for building lasting value for the organization and ensures that procurement and the business are properly aligned before taking action. Yet it is still something that many if not most procurement organizations struggle to do. While this is a time intensive process, the value generated vastly offsets the effort. The process requires significant time spent by procurement and willing partners in the business, if this is going to be done properly.

Thinking back, I believe that a big part of the problem was that we did not have a good idea or template for developing robust category strategies. Here are some of the elements that I think are critical and important to developing impactful category strategies.

- Engage Key Stakeholders. Comprehensive strategies require the input of your key internal clients. They need to be the decision makers and thought leaders, often senior leaders of a function. These are the people who are charting the course of their function and they need to share their plans for the future and their thoughts on what they need from the supply base. I still recall a conversation with the president of one of our major business units. We had some issues in the past and the relationship needed some work. But when I asked him what his key business priorities were for the coming year and what we might do to help him achieve his objectives, that relationship suddenly improved. He said “Tony, I have been waiting for you to ask me that question for some time.” And that was the beginning of a much better business relationship and us becoming a true partner in his business.

- Take Time to Truly Understand the Business. What are the key objectives of the business? What are its key challenges? How are these things likely to change over time? It is critical to understand these things so that the plans you put in place, with the strong support of the business, are a good fit not simply a quick fix for something needed today. I have always been a proponent for Procurement sitting in on budget and strategic planning sessions for the business. What better way to get close to the business and develop a strong partnership that helps them achieve their business goals?

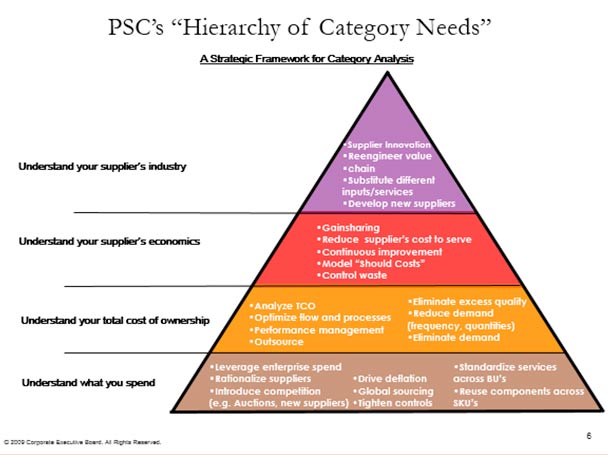

- Understanding the Spend is an Integral Part of Developing a Category Strategy. It is so important to do the leg work and get a good idea of what you are spending in each major category. This provides the opportunity share information with your internal clients and to shine some light on historical spend patterns. It is amazing that when this information is shared with the key stakeholders that they are often unaware of the amount of business that the company is doing with various suppliers or simply the sheer number of suppliers being engaged. Using this as a baseline, the discussion can turn to how this spend might change in the future, the need for different or highly specialized suppliers or the importance of such things as improved quality, customer service, technology or innovation from the supply base.

- Benchmark the Supply Base. All too often, when looking at the supply base or drafting an RFP, my internal clients would suggest that we might go through all the effort but they are certain that the current supplier is the best fit for them. Yet after doing our research, we often find that the marketplace has changed drastically over the last couple of years and new entrants are offering radically different value propositions. The supply market changes at an astonishingly fast pace and we need to perform the due diligence to determine if it will or can impact our business. This type of evolution in the market place can have an incredible impact on your business if embraced. Suppliers are constantly under pressure to improve, evolve and innovate in order to maintain their competitive advantage. Your best suppliers have a penchant for innovation and solving your ongoing problems. The key is finding those suppliers who have an interest in doing this with your help and then treating them like partners in the business. Understanding what is new and different in a particular category must be part of developing your category strategy as it can have a tremendous impact on how you do business and interact with your customer base.

- Review the Performance of Key Suppliers. Beyond reviewing spend, evaluating the performance of your suppliers will provide a baseline for understanding what is working well, what needs to change and if the existing supply base is well suited to meet the new demands facing the organization. Whether this be a review of the periodic supplier meetings or determining if KPI’s are favorable and being met, this information is so important. The obvious questions are “How are we doing? Where could we improve? And are there new requirements that are needed in the future?”

- Develop the Category Strategy. You have now done all the preparatory legwork. Now it is time to have those in depth discussions with the business and establish the category strategy that will become the foundation for all future sourcing actions in the category. You will be amazed at how quickly the strategy develops, having done all of this work in advance.