How the Global Strategic Sourcing organization at Bristol-Myers Squibb plans to deliver its next billion in cost savings.

“Supplier relationship management will become our battle cry for the next 5-10 years,” says Anthony Santiago, Vice President of Global Strategic Sourcing and Financial Shared Services.

Agreat danger for top purchasing execs is that success breeds high expectations. Bank $250 million worth of savings one year and top brass will be looking for $300 million the next. Bristol-Myers Squibb has been sourcing strategically since 1996. Between 1996 and 2002, the company’s Global Strategic Sourcing (GSS) group delivered $1.6 billion worth of savings on a total corporate outlay that can approach $10 billion each year. The group has leveraged—to a great extent— the company’s spending for such categories as chemicals; packaging and print; contract manufacturing; lab supplies, equipment and services; IT hardware, software, and professional services; facilities maintenance, repair and operations (MRO); creative services and advertising; market research; medical education; events; clinical trials; diagnostic services; telecommunications; consulting services; many human-resource related buys, and more.

So, with its low hanging fruit largely harvested, GSS is beginning to implement strategies for delivering a big return on investment in the 2003-2005 period. Anthony Santiago, vice president of global strategic sourcing and financial shared services at Bristol-Myers Squibb, credits much of the group’s early success to both “method and people.”

He says the group worked with a well-known management consulting company to develop a six-step sourcing methodology. “We found that we didn’t have the level of rigor that we needed in our sourcing process. In many cases, we were just placing orders rather than sourcing. The consulting company was very helpful with methodology. They also provided the human resources we needed to go through our initial waves of sourcing in order to prove there were benefits to pursuing leverage. As we built our business cases, we started using fewer consultants and hiring more people,” Santiago says.

He notes that Bristol- Myers Squibb invested substantially in upgrading the expertise of professionals it dedicates to strategic sourcing through a combination of new hiring practices, internal recruitment from other functions, and plenty of professional training for GSS employees. “Our biggestasset is our people. GSS now comprises people with backgrounds in business process reengineering, financial analysis, procurement, plus many subject matter experts from Bristol-Myers Squibb organizations including contract research, advertising, marketing, chemistry, information technology and packaging,” Santiago says. “We’ve brought people in from other organizations and taught them our methods of sourcing. Because they’re experts, they have immediate rapport and instant credibility with our internal clients.”

Kathleen Millsap is a good example of this. She is a microbiologist and was a bench scientist for Bristol-Myers Squibb before joining the productivity initiative that became Global Strategic Sourcing in 1996. “They loaned out scientists to support the productivity initiative because they wanted subject matter experts who knew what we needed from suppliers to be making the recommendations for which suppliers we would be using,” Millsap says. Millsap who was initially the category leader for sourcing laboratory supplies is now associate director in Global Strategic Sourcing, supporting the marketing and services categories.

In years three and four of the group’s existence, Santiago notes that GSS hit somewhat of a plateau where annual savings diminished—from $252 million in 1997 to approximately $200 million in 1998 and 1999. This inspired the group to shift its focus to both “alignment and technology,” according to Santiago.

GSS reorganized to create “single points of contact” with Bristol-Myers Squibb business units. Says Santiago: “We moved more of our people nearer to our internal clients and made it easier for them to interact with us.” At the same time, the general procurement group at Bristol-Myers Squibb made a move to specialize its buyers around categories rather than sites. “This helped the buyers to become more aligned with our category leaders,” says Bill Stirling, senior director, general procurement and fulfillment for GSS. “The buyers became experts who could really help clients as opposed to simply placing orders.”

To keep its savings trend sloping upward, GSS is implementing stricter purchasing policies and working with suppliers to identify process improvement opportunities.

Where buyers at Bristol-Myers Squibb were once dedicated to specific sites, Stirling says technology also allowed them to become more virtual. “It no longer matters where the buyer resides. Today, a buyer may purchase a whole family of commodities or services for an entire location or country.” Also in 1996-1997, Bristol-Myers Squibb undertook a single enterprisewide implementation of SAP’s Enterprise Resource Planning (ERP) software. That made it possible for GSS to build a data warehouse—called Business Warehouse—that provides a constant stream of accurate spend data instead of engaging in time-consuming one-off analyses for sourcing projects. In 1999, a “Web EDI” implementation using technology from ECOutlook allowed some 4,000 Bristol-Myers Squibb suppliers to begin receiving purchase orders electronically and then “flipping” them automatically into invoices. That, according to Santiago, cleaned up the payment process, making it feasible for GSS to take advantage of supplier discounts for early or ontime payments and took a great deal of paper out of the system. Tom Spak, director of sourcing effectiveness notes that, taken together, the SAP and ECOutlook investments enabled a basic, but very important, policy change that would allow Bristol- Myers Squibb to exert more control over its highly decentralized spend. “Before that time, we did not have a uniform policy requiring a purchase order before an invoice could be paid,” Spak notes. “It was a policy we had been wanting for years, but, finally, the stars were lining up. We were able to go to senior management and say, ‘The

good news is that we have already made all the necessary information technology investments to support this policy. The bad news is that we aren’t using the technology fully’.” At the time, GSS estimated purchasing bypass—dollars being spent without purchasing’s influence—at around $1.8 billion of indirect spend in the U.S. “Because the systems were in place, the purchase order policy was an easy sell,” Spak says. “After a thorough communications and change management process, we started rejecting invoices that didn’t have purchase orders.” The policy had the added benefit, Spak says, of increasing procurement card use as people balked at using POs for low dollar, high volume buys. An Ariba e-procurement installation also made it easier to promote, track and enforce compliance to strategic supply contracts at Bristol-Myers Squibb, according to Spak. These alignment, purchase order policy and technology moves succeeded in placing the GSS savings trend line back on an upward-sloping curve, according to Santiago. Now, to keep the line tracking steadily upward, the group is working on several new initiatives:

- An early involvement policy,

- An implementation of Frictionless Commerce software for automating and tracking the strategic sourcing process,

- A push into “Express Proposals”, which is Bristol-Myers Squibb-speak for electronic auctions, and

- Greater emphasis on supplier relationship management, including plans for partnering and active solicitation of cost savings, productivity and innovative technology ideas from suppliers,

“Supplier relationship management will become our battle cry for the next five to ten years,” Santiago says.

Early involvement

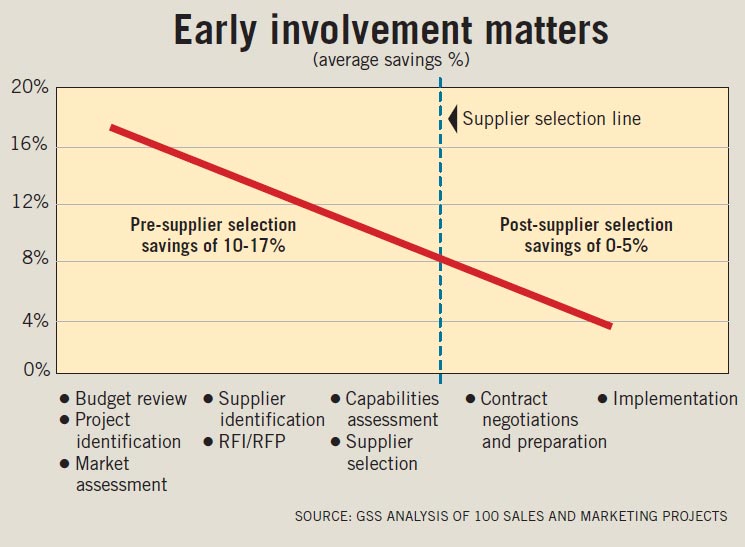

In the same way its purchase order policy went after an estimated $1.8 billion worth of nonproduction expenses that were bypassing the purchasing group each year, GSS at Bristol-Myers Squibb is now setting its sights on an estimated $1.6 billion worth of spending that, it feels, is coming to purchasing too late in the decision cycle to achieve maximum sourcing effectiveness. “Requiring purchase orders got us part of the way, but it didn’t get us early involvement,” Spak says.

Timing is everything, however. “In a company of this size,” Santiago says, “you have to time big policy changes carefully. At Bristol-Myers Squibb, we had seen some significant growth over time. Then the economy turned for the worse, so we felt the time was right for a more stringent purchasing policy.

This research helped Global Strategic Sourcing (GSS) to win executive support for a policy that requires all Bristol-Myers Squibb employees making expenditures to consult GSS personnel early in their spend decision processes.

We saw an opportunity to go to management and say, ‘There is more we can do.’” To make its case to senior management, GSS conducted a study of 100 different sourcing projects it had worked on. What the group found was a direct correlation between the level of savings achieved and the timing of purchasing’s involvement in the sourcing process. Says Santiago: “We were looking at savings averages of 10-17% if we became involved at the time the client was planning strategy or initiating dialogue on budgets. That compared to an average savings of only 0-5%—usually at the low end of the range—if we were becoming involved only for contract preparation, after a supplier had been selected.”

GSS is now setting its sights on an estimated $1.6 billion worth of spending that—it feels—is coming to purchasing too late to achieve maximum sourcing effectiveness

Santiago, Spak and others took their research on the road, presenting it to key executives including the company’s CEO and acting CFO. Says Spak: “Of the 12 major executives we met with, none objected, although some expressed fears that an early involvement policy might slow projects down.”

Back in 1996, such fears might have been well founded, says Bill Eisenbrey, vice president of North American and European indirect sourcing for GSS: “In the beginning when GSS was first being established, we weren’t really ready for a policy on early involvement. At the time,” he says, “we were busy getting our infrastructure together, becoming involved in different spend categories, obtaining results, and hiring people category by category. Today, we are much better equipped for this kind of policy.”

Good fortune had Bristol-Myers Squibb’s corporate Code of Conduct under periodic revision at about the same time GSS was winning executivelevel support for its early involvement policy. “In fact,” says Spak, “we held up the revision a bit, because we really wanted to get our policy written into the new code.” Adds Santiago: “With people more aware of the policy, we are receiving calls from people saying, ‘We’re buying things. Now we’re coming to you.’ It has really generated a lot of new business for us.“

There’s more to this than the code of conduct, however. GSS has also run a carefully orchestrated change management effort, complete with compliance metrics, to ensure that the early involvement policy takes deep root in the Bristol-Myers Squibb culture. \

According to Kathleen Millsap, GSS developed a change management grid comprising 18 tasks for introducing the policy to all business unit leaders, their direct reports and on down through the Bristol-Myers Squibb corporate organization. For each of the 18 steps, GSS developed a communications “tool kit.” For example, it drafted standard

and customized communications for senior executives to distribute to their staffs. The group placed articles about

the policy in an employee Webzine called intouch@BMS, distributed customized post-it note pads, and also made sure the policy information would be incorporated into orientation packages and training for new employees. “We made the transition very user friendly for our executives,” says Millsap. “We also ensured that the message would be very consistent from one business unit to the next.”

For compliance tracking, which starts this quarter, buyers will be coding purchase and change orders of $50K or greater with “1” for impact, meaning the buyer has been involved throughout the sourcing process, or “2” for no

impact, meaning that purchasing has had little or no participation in the supplier selection process. “We’ll enforce

the policy in a gradual way,” says Spak. “We’ll start with friendly reminders, then escalate enforcement with people

who are not following the policy consistently.” He adds that, “One of our business unit presidents has already said he wants us to tell him who in his organization is not coming to GSS early enough. He wants to explain to them why they need to adhere to the policy and make the transition to this new way of working.”

Supplier partnering

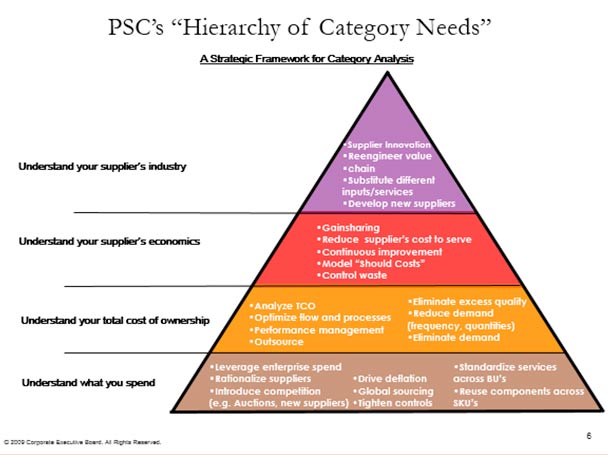

“One thing that we’ve talked about for many years is the idea that we’re going to run out of steam in terms of leverage,” Santiago remarks. “So we want to shift our focus to making processes better as opposed to making bad processes cheaper,” he says.

This thinking has given birth to an initiative that GSS has named, rather straightforwardly, supplier partnering.

“In terms of developing the supplier partnering program,” says Don Fawcett, director, for GSS, “we recognized that we couldn’t go on exploiting leverage forever. With the potential for $10 billion in annual spend, we knew we could source part of that every couple of years, but were missing significant opportunities to work on process improvements affecting all of the spend every year.”

Fawcett notes that GSS had made some attempts at initiating process improvements with strategic suppliers. “But those attempts were in select areas,and our successes tended to be confined to areas, such as lab supplies, where Global Strategic Sourcing was the primary supplier stakeholder or controller of the supply relationship.”

GSS experienced considerably less success with its ad hoc improvement efforts when the primary stakeholders resided with Bristol-Myers Squibb business units, Fawcett notes. “They were always interested in the ideas, but they had their day jobs to do. It was difficult to attract people to our projects, so we decided to come out with a more formalized program that would be sanctioned by senior management.”

GSS kicked off its formal supplierpartnering program in the fall of 2001. The basics, according to Fawcett:

“We’re going to run out of steam in terms of leverage. So, we want to shift our focus to making processes better as opposed to making bad processes cheaper,” says Santiago.

- Focuses on the top 100-150 BMS suppliers (in terms of dollars) who represent approximately 50% of Bristol-Myers Squibb spend. (There are some exceptions, Fawcett notes. “We include some critical suppliers with whom we don’t spend a large percentage of our dollars.”)

- GSS actively recruits sponsorship from business unit stakeholders for workshop sessions with supplier partners. The sponsor sets a timeline for completion of workshops and idea generation.

- In advance of workshop sessions, GSS people interview both business unit stakeholders and supplier personnel for background on how the relationships work. They also survey suppliers targeted for workshop sessions (sample questions on page 30).

- GSS personnel facilitate one-day workshops comprising key personnel from the business unit stakeholders and suppliers. GSS asks suppliers to send executives and account managers but also to involve people who actually do the work of interacting with Bristol-Myers Squibb. The goal of the workshops is to identify significant opportunities for process improvements. Workshops include process mapping exercises followed by brainstorming sessions.

- Sponsors review lists of improvement ideas coming out of workshops and choose high opportunity ideas for implementation.

One example of a successful supplier partnering implementation occurred between the sales and marketing organization for Bristol-Myers Squibb’s Primary Care Group and six suppliers that the group’s President, Dean Mitchell, selected for workshops. Says Fawcett:

“He chose the suppliers he wanted us to work with and sent a note to his staff asking them to participate. Many of the 50 to 75 ideas generated in the workshops were focused on requirements we place on suppliers. They came from suppliers asking simple questions about they way we operate.”

Example: One of the suppliers chosen by Mitchell puts on very large meetings for Bristol-Myers Squibb to learn about new product launches. “We might fly in a couple thousand of our salespeople to talk about a new drug and how it will be used to treat patients,” Fawcett says. The supplier, in its workshop, noted that Bristol-Myers Squibb had no guidelines for when people should purchase their airline tickets to attend these events. “We looked at the data,” says Fawcett, “and found that more than half of the tickets were being purchased within three weeks of the events.” A simple followup guideline instructing sales personnel to purchase air tickets more than three weeks in advance of the events is expected to yield annual savings of $400K for Bristol-Myers Squibb, according to Fawcett.

Another workshop conducted for the Primary Care Group occurred with a supplier that runs small educational meetings with physicians. In its workshop, the supplier noted that Bristol-Myers Squibb’s sales reps were renting, through the supplier, LCD projectors at a daily rental cost of about $500/day. (The machines can be purchased for around $2,000 each). “These were passthrough expenses for the supplier,” says Fawcett, “and they were being covered through T&E, which is why they weren’t showing up on our radar screens in GSS.” A follow-up survey on how frequently sales staff were renting LCD projectors led to a decision to purchase a machine for each sales office. Projected annual savings, according to Fawcett, are expected in the $1-$2 million range. “Now that the LCD projectors are owned, we expect them to be used more frequently, which will improve the value of our investments even further,” he adds.

A benefit of having GSS coordinate the supplier-partnering program across Bristol-Myers Squibb is that it can leverage the ideas generated to all other business units as well, Fawcett notes.

The long-term plan, according to Fawcett, is to follow these quick-hit workshops with more periodic supplier meetings and formal performance metrics. GSS also envisions suppliers extending similar process improvement exercises to their own supply chains.

“This isn’t just a one-shot initiative,” says Santiago. “We expect to start an ongoing dialogue throughout the year so suppliers can hear more about our business and share more with us about what they are doing that is innovative.”

Survey questions for supplier partnering

Bristol-Myers Squibb’s pre-workshop supplier partnering survey asks suppliers to list important cost, time and quality drivers in delivering their product or service to Bristol-Myers Squibb. Other questions:

- How does your interaction with BMS compare to your other customers? When you think of your best customer, what is it about that relationship that makes it superior to others?

- Think of a project or service work you performed for BMS that you feel went well. What happened that made it successful?

- Think of a project or service work you performed for BMS that you feel went poorly. What happened to make it unsuccessful?

- What are some of the key interaction points between you and BMS (examples include discussing project specifications, revisions to advertising content, order quantity changes, etc.)

- If you deal with more than one person at BMS, are your interactions consistent or standard from person to person? In other words, is there a standard process in the way you work with BMS or does it vary depending on whom in BMS you are working with?

- What does BMS do well?

- What does BMS not do well?

- What can BMS do differently to help you lower costs, improve service, or reduce cycle times?

- What do you do well?

- What do you not do well?

- What areas overall in the relationship do you think can be improved?

Says Anthony Santiago, vice president, global strategic sourcing and financial shared services for Bristol-Myers Squibb: “Simple questions like ‘What do you do with your best customer?’ or ‘How do we drive your cost structure in inappropriate ways?’ are great lead-ins for our suppliers to open up and say ‘I’m glad you asked. This is what we can do together to take work out of the system.’”

Supplier ideas

While supplier partnering focuses on maybe 100-150 critical suppliers, comprising roughly half of Bristol-Myers Squibb’s annual spend, another program, still in its infancy, will extend the concept to a much larger portion of the strategic supply base—say 500 suppliers covering 80-85% of total spend.

The idea actually came from an ongoing process benchmarking initiative in which GSS periodically invites reps from select supply management organizations to participate in focused two-day roundtable discussions.

“We were impressed,” says Spak, “with another company’s program.” This program will be communicated to top suppliers at an annual conference. The top management team will take the opportunity to share business objectives with suppliers and clearly communicate expectations of working together to generate innovative costsavings measures. “We will support this with a Web-based technology interface for soliciting, evaluating, ranking, and acting upon ideas submitted by suppliers,” says Spak.

A first necessary step, according to Spak, will be to set up a goal structure for suppliers focusing on cost reduction, productivity improvement, quality improvement, or whatever else might be appropriate for pointing suppliers

toward the kinds of ideas that will result in increased value for Bristol-Myers Squibb. While GSS does not yet have a

goal structure in place for its suppliers, he notes that, through Business Warehouse, it already has the data infrastructure for creating one. “In the past, we have set our cost reduction goals by family of spend, but not by individual supplier,” Spak notes.

“We could do this program without goals, he adds, “but we think specific objectives will create a tangible record of our expectations and encourage suppliers to orient their ideas toward meeting them. The reward for meeting our goals will be more business. The penalty will be loss of business.”

By actively soliciting improvement ideas from suppliers, the Global Strategic Sourcing group at Bristol-Myers Squibb thinks it can more than double its per-supplier savings over a three year period.

According to Beatriz Loizillon, associate director of sourcing effectiveness for GSS, the group is evaluating software options, focusing on those that provide an ability to build evaluation criteria right into the submittal process. “The software we choose will assist with scoring of ideas according to criteria we set,” she says. The submittal form, she notes, will require suppliers to provide estimated returns on investment for their ideas.

Spak says GSS is still in process of pitching the innovative ideas program to senior management and business unit leaders throughout Bristol-Myers Squibb. “We’re not going to roll this prigram out,” he says, “until we can commit to our suppliers that we will evaluate and act on their ideas in a timely manner.”

So far, Spak says the response has been positive, although he notes that some managers are worried about overloading the troops, especially with all the new sourcing work coming to Global Strategic Sourcing through the early involvement policy.

Frictionless Commerce

With so many strategic initiatives underway, it’s no wonder that GSS managers are beginning to worry about spreading their resources too thinly. But, that’s where Frictionless Commerce comes in.

Frictionless Commerce is an enterprise sourcing software application that will create a systems bridge between the GSS Business Warehouse—where spend data is first collected and organized— and the SAP, Ariba, and ECOutlook systems—where day-to-day purchasing transactions are executed.

Frictionless, in effect, is the software GSS has chosen to automate and control its activities for advanced spend analytics, collaborative development and refinement of RFx specifications, market making—electronic RFx and “Express Proposals” (auctions)— plus negotiation and creation of strategic supply contracts. (Note: Documents pertaining to completed GSS contracts are managed in an information system driven by Documentum software).

According to John Tuttle, associate director, sourcing effectiveness for GSS, the Frictionless system offers strong project management capabilities in a collaborative sourcing environment. It also represents a way to pass critical

data cleanly from one step of the sourcing process to the next.

A first step in the ideas program will be to set up a supplier goal structure for cost reduction, productivity improvement, quality improvement, or whatever else may be appropriate.

GSS expects the Frictionless Commerce system to:

- Increase productivity by automating the sourcing process from project initiation through RFx creation, bidding events, and supplier management,

- Encourage stakeholder involvement by providing a collaborative workspace accessible to stakeholders across the organization,

- Improve the sourcing process and drive savings by sharing best practices throughout the enterprise, and

- Provide a procurement portal tailored to the specific interests and needs of GSS personnel and management.

Santiago has mandated that, in order to receive credit for their work, GSS personnel must enter all sourcing savings projects into the Frictionless system (with greater detail required for all savings projects exceeding three person- weeks in duration). He also encourages GSS personnel to use the system wherever it meets their needs for project management on nonsavings projects they may be undertaking.

System configuration and testing was completed in January. By the end of April, all GSS personnel will have undergone two full days of Frictionless training. An imminent upgrade to version 3.0 will add more functionality and expand use, according to Tuttle.

Electronic auctions (“Express Proposals”) are a central part of the Frictionless implementation. For the auction piece, Tuttle notes that GSS has two people who are specialists in auctions. By Santiago’s reckoning, Express Proposals alone could generate up to $40 million in savings by 2005.

“This is an exciting time for GSS,” says Santiago. “We have many new ways in which to drive value for the company and we are partnering with our business units better with every passing day.”

High Hanging Fruit BMS

High Hanging Fruit BMS